TAX the RICH - USA

➡️ TAX THE RICH – The U.S. Wealth Tax Debate

The current U.S. tax system rewards wealth over work thanks to a tax code which favours income from wealth. As a result, billionaires pay a smaller tax rate than ordinary working Americans.

The wealthiest 400 families in the U.S. pay an average tax rate of 8%, while the average American tax payer pays 13%.

As inequality widens, the importance of fair taxation has taken on a new urgency.

- The official poverty rate in 2022 was 11% equating to 37.9 million people

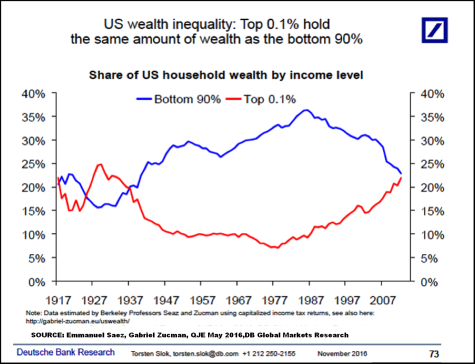

- 67% of total wealth in the U.S. is owned by the top 10% of earners

- There are 748 billionaires living in the U.S. whose wealth increased by 88% in the last four years

- 64% of Americans support a wealth tax on the super-rich

As corporate profits and billionaire wealth balloon, everyday families struggle to pay bills, provide food for their families, and cover medical costs.

55 of America's largest corporations paid no federal corporate income tax in 2021 in a decades long trend of corporate tax avoidance. In 2017, the U.S. government is estimated to have lost $135 billion to tax loopholes and avoidance strategies by corporations.

A tax proposal by Biden called the Billionaire Minimum Income Tax law proposed a 25% tax on all wealth over $100 million and would apply to only 0.01% of Americans, but it never made it through Congress.

The 2017 Trump tax law was so skewed towards the rich it allowed tax cuts of $60,000 for those in the top 1%, meanwhile those in the bottom 60% received an average tax cut of $500!

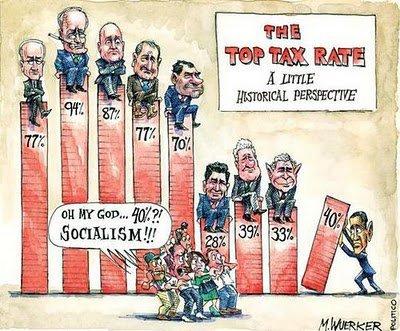

Over the years, progressivity of the U.S. tax policy has dramatically declined – in 1950 the super-rich paid around 70% of their income in taxes, by 2018, this figure had gradually been reduced to around 23%. To serve the interests of the super-rich, the U.S. tax system has become much more regressive.

Organisations such as Greenpeace, Oxfam, and Fight Inequality are campaigning for the implementation of a fair and progressive tax system which ensures that people from all backgrounds contribute their share to society.

With the USA becoming more of an oligarchy, Senator Bernie Sanders in a recent video shared the following facts:

-

3 people in the U.S. - Musk, Zuckerberg and Bezos - combined own more wealth than the bottom half in the U.S.

-

60% of Americans live paycheck to paycheck

-

85 Million Americans are uninsured or underinsured

-

25% of seniors live on < $15,000 per year

-

800.000 are homeless

-

the USA has the highest rate of childhood poverty of almost any major country on earth

Pros of a Wealth Tax in the U.S.

One of the most effective ways to reduce economic inequality and wealth concentration is to inject greater fairness into the US tax code.

In 2020, average income for the highest fifth of earners was $357,800 and $21,900 for the lowest fifth. This income for the highest group is 135% higher than it was in 1980, so not only the rich staying rich, they are getting even richer. This figure is over three and a half times the growth of those in the lowest fifth.

The concept of a wealth tax was pioneered by French economist Thomas Piketty. It is estimated that progressive taxation of US multi-millionaires and billionaires would generate $664 billion annually to help fund essential services such as healthcare, education, social security, and lift people out of poverty.

Although Federal taxes are considered to be taxed progressively, they still only tax on income. The vast majority of wealth held by billionaires is not paid in income, their wealth is in the form of stocks, shares, and investments.

Citizens have been waiting for decades for politicans to close the loop holes that enable tax evasion, reduce tax haven abuse, the offshoring of corporate profits, ensure that they pay a global minimum tax rate, and enforce greater transparency. It's time to vote for progressive candidates!

Cons of a Wealth Tax in the U.S.

Opponents of tax hikes on the wealthy often cite potential economic risks such as reduced investment, lower economic growth, and capital flight. Higher taxes can disincentivise business investments and entrepreneurship, as individuals and corporations might see reduced returns on their investments. There is also the risk of high earners relocating to countries with more favourable tax systems.

One of the biggest issues with a wealth tax is valuation. Many of the super-rich hide their wealth in companies and trusts under disguised ownership. It is incredibly difficult to determine the market value of many kinds of assets such as art, cars, race horses, shares etc. In order to accurately assess the value many more tax inspectors must be employed.

A Wealth Tax for a Better World?

Globally, just a modest tax of up to 5 percent on the world’s richest individuals could bring in $1.7 trillion in a year, enough to lift 2 billion people out of poverty.

The idea of a wealth tax is not just utopian idealism. This system is already in place in Colombia, France, Norway, Spain, and Switzerland. Tax is a tool that can be used to create a more equal society and to help fund services that benefit the wider community.

Wealth tax is a hot topic as in April, the finance ministers from Brazil and France announced their plans to implement a 2% tax on billionaires. Brazil, the 2024 host of the G20 summit, commissioned an investigation into the viability of a global wealth tax. It revealed that a tax on those with assets over $100 million could be enforced even without the backing from every country.

More than two-thirds of people across the G20 countries are in favour of the measure as a means to fund and address global issues such as poverty and the climate crisis.

Proposals for a Robin Hood tax on the millions of financial transactions is another popular idea. Banks are turning over vast profits and bosses are rewarding themselves with gigantic bonuses, financial transaction tax would impose a tiny tax on the purchase of assists such as shares, bonds, and derivatives. It has been estimated that a tax of just 0.1% would raise a further $777 billion in 10 years.

Another way to impose higher taxes on the wealthy includes abolishing VAT and replacing it with a luxury goods tax. This would create a massive working-class tax cut and increase the cost of luxury consumption for the rich.

An estimated $4 trillion is thought to be held in offshore tax havens by U.S. residents, and $150 billion in tax revenue is lost every year due to tax evasion through fraud and underreporting of income.

The combined wealth of America’s billionaires in 2022 was $4.5 trillion! There is plenty of money, it just needs to be fairly taxed, and then invested back into the public.

Author: Rachael Mellor 01.08.24, licensed under CC BY-ND 4.0.

For more information on a U.S. Wealth Tax see below ⬇️

- Megarich Democratic Donor Says 'Tax Rich People Like Me' or He's Done With the Party - Common Dreams 04.10.21256616

- The Simple, Effective Wealthy Surtax We Need - CD 20.09.21257737

- 'Tax These Moochers': Top 1% Dodge $163 Billion in Taxes Each Year - CD 09.09.21256993

- Patriotic Millionaires Launches New Campaign to Boost Fight for Economic Justice - Common Dreams 02.09.21254447

- Elon Musk’s tiny home won’t help save the world. Paying more taxes would - Guardian 14.08.21256114

- Unrig the Tax Code Now - CD 24.06.21249658

- Billionaire Peter Thiel amasses $5bn tax-free nest egg in retirement account - Guardian 24.06.21249582

- Progressives Say 'Do What the People Want and Tax the Rich' to Pay for Infrastructure - CD 21.06.21250335

- Making sure the ‘big people’ pay their taxes would be a boost to democracy - Guardian 16.06.21248294

- Biden corporate tax plan could earn EU and UK billions, study shows - Guardian 01.06.21246356

- The Tax Loophole You've Probably Never Heard of Is Making the Rich Even Richer - CD 18.05.21246241

- Millionaires who support taxing the rich protest in front of Jeff Bezos’s homes - Guardian 17.05.21247346

- Biden Proposes Hiking Taxes on Richest Americans to Fund Universal Pre-K, Paid Leave, and More - CD 28.04.21245179

- Billionaires Do Not Give Anything to Society—They Take From It - CD 22.04.22284613

- Tax the Rich. Here's How - CD 02.04.21242969

- Video: What if We Actually Taxed the Rich? | Robert Reich 02.04.21240063

- Video: Tax The Rich! Save America — The Roadshow 30.03.21240064

- Nearly 3 in 4 New Yorkers Favor Taxing the Rich to Austerity: Poll - CD 26.03.21239620

- The Rich Are Not Remotely Paying Their Fair Share - CD 18.03.21239619

- Biden Eyes Tax Hikes for Rich, Ending Fossil Fuel Subsidies to Fund Infrastructure - CD 23.03.21239412

- Joining Powerful Finance Committee, Warren Vows to Introduce Wealth Tax as 'First Order of Business' - CD 03.02.21237872

- House Democrats Demand Increase in IRS Funding to Go After 'Wealthy Tax Cheats'—Like Donald Trump - CD 01.12.20227879

- Video : Tax The Rich! Save America Roadshow - Q&A with Rep. Jamie Raskin - Patriotic Millionaires on YouTube 30.10.20240086

- Either Raise Taxes on Wealthy to Fund Recovery or Expect Years of 'Grinding Recession,' Argues Nobel Prize-Winning Economist - CD 03.09.20215605

- Tax the Rich and Divert Billions From NYPD Budget to Fund Public Hospitals, Says Nurses Union - CD 22.06.20212143

- Financial Transactions Tax Would Cost Most People Little, Be Paid by the Wealthy - Common Dreams 16.09.19189636

- Most Millionaires Want Higher Taxes For Millionaires: Survey - Huff Post 10/11104101

- Nurses Join Call to "Tax Wall Street" - IPS 6/11104107

- Most Americans Say Tax Rich to Balance Budget: Poll 81% Say Tax Rich or Cut Military; 3% Say Cut Social Security - Common Dreams 1/11150835

- Buffett says rich should pay more tax - FT 11/10150843

- Inherited wealth shouldn't get a free pass on taxes - LA Times 6/10150851

- The Rich Who Say, “Tax the Rich!” 12/07150859

- No Free Ride for Mega-Rich Heirs, Billionaire Urges - Warren Buffet 11/07104125