TAX The RICH - UK

➡️ TAX THE RICH – The UK Wealth Tax Debate

Did you know that the majority of UK millionaires and billionaires actually pay lower rates of tax than ordinary working people such as teachers and nurses?

This is because income is taxed at a higher rate than wealth meaning that those who gained their wealth through investments or rising property values (the majority of millionaires), pay a lower percentage of tax.

Currently, the lowest 10% of earners have an effective tax rate of 44%, more than twice as high as those in the top 0.01%.

-

In 2021/22 more than 1 in 5 people in the UK were living in poverty – 14.4 million people

-

The wealth of the richest 1% of households is greater than the entire bottom 80% of the population

-

The covid-19 pandemic saw the number of billionaires in the UK increased by 20%

Public support for a UK wealth tax is overwhelming with 78% advocating for an annual wealth tax for those with assets worth over £10 million. Organisations such as Greenpeace, Tax Justice, and the Just Money Movement are campaigning for the implementation of a fair and progressive tax system which ensures that people from all backgrounds contribute their share to society.

Pros of a Wealth Tax in the UK

Even just a 2% tax increase on those with assets over £10 million could raise £22 billion per year. This is enough to cover the average salary cost of more than 600,000 nurses a year.

By taxing the wealthy, the government would be able to generate revenue to fund essential public services such as healthcare, education, and social security. These services especially benefit lower income households at very little cost to those on much higher incomes.

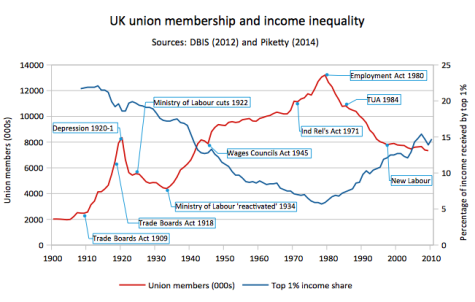

Economic inequality in the UK is at an all-time high and has been increasing year on year since the 1980s. This tale of two-Britons has been highlighted by the unprecedented NHS nurse and junior doctor strikes, the rail strikes, massive increases in union membership, and huge class wage disparity.

Cons of a Wealth Tax in the UK

Opponents of tax hikes on the wealthy often cite potential economic risks such as reduced investment, lower economic growth, and capital flight. Higher taxes can disincentivise business investments and entrepreneurship, as individuals and corporations might see reduced returns on their investments. There is also the risk of high earners relocating to countries with more favourable tax systems.

One of the biggest issues with a wealth tax is valuation. Many of the super-rich hide their wealth in companies and trusts under disguised ownership. It is incredibly difficult to determine the market value of many kinds of assets such as art, cars, race horses, shares etc. In order to accurately assess the value many more tax inspectors would need to be employed.

A Wealth Tax for a Better World?

The idea of a wealth tax is not just utopian idealism. This system is already in place in Colombia, France, Norway, Spain, and Switzerland. Tax is a tool that can be used to create a more equal society and to help fund services that benefit the wider community.

Wealth tax is a hot topic as in April, the finance ministers from Brazil and France announced their plans to implement a 2% tax on billionaires. Brazil, the 2024 host of the G20 summit, commissioned an investigation into the viability of a global wealth tax. It revealed that a tax on those with assets over $100 million could be enforced even without the backing from every country.

More than two-thirds of people across the G20 countries are in favour of the measure as a means to fund and address global issues such as poverty and the climate crisis.

Proposals for a Robin Hood tax on the millions of financial transactions is another popular idea. Banks are turning over vast profits and bosses are rewarding themselves with gigantic bonuses, a financial transaction tax would impose a tiny tax on the purchase of assists such as shares, bonds, and derivatives. It has been estimated that this would raise a further £5 billion a year.

Another way to impose higher taxes on the wealthy includes abolishing VAT and replacing it with a luxury goods tax. This would create a massive working-class tax cut and increase the cost of luxury consumption for the rich.

An estimated £570 billion is thought to be held in offshore tax havens by UK residents, and £35 billion in tax revenue is lost every year due to tax evasion through fraud and underreporting of income.

The UK, spurred by 14 years of Conservative rule, austerity, and political instability is currently struggling with multiple crises including cost-of-living, a housing shortage, the dismantling of the NHS, and high inflation. A fairer tax system could play an important role solving these issues.

The combined wealth of Britain’s billionaires in 2022 was £653 billion. There is plenty of money, it just needs to be fairly taxed, and then invested back into the public.

Author: Rachael Mellor 28.07.24, licensed under CC BY-ND 4.0.

For more information on UK Wealth Tax see below ⬇️

- Tax Justice - Taxing wealth304181

- Wealth Tax Commission304182

- Just Money - Wealth Tax Campaign422121

- Tax Justice - Ask your MP to tax the super rich422131

- Guardian - The super-rich190767

- Independent304202

- Wealth tax - Wikipedia304186

- Patriotic Millionaires UK405070

- @PatMillsUK405069

- Tax the rich: Join the fight for a fairer future - Oxfam452731

- The Taxing Wealth Report 2024 - TaxingWealth UK (must read)452730

- Oxfam petition: Ask the PM to increase tax on the wealthiest to fight poverty304192

- Majority of public say that the wealthy should pay more tax to fund public services, poll finds - LFF 25.03.25462707

- #TaxTheSuperRich campaign gains momentum - LFF 08.02.25457155

- Tax the rich – do it now. Start with me - Guardian 23.01.25452237

- Tax the world’s super-rich already - Oxfam - Ecologist 20.01.25451467

- Economists, Advocates Call On G20 Ministers to 'Make History' and Tax Superrich - CD 12.11.24443314

- Britain cranks up taxes by £40B and gambles on growth - Politico 31.10.24437782

- Richard Burgon MP: Why we need Wealth Taxes, not more cuts in the Autumn Budget - LFF 29.10.24437603

- Britons are in favour of increasing taxes on businesses and the rich in order to improve public services, poll finds - LFF 29.10.24437602

- £130bn National Renewal Tax on the super-rich could insulate all draughty UK homes, fund free bus travel, green jobs and more, new report finds - Greenpeace 15.10.24452729

- Are the rich going to leave? - TaxResearch 12.10.24452728

- Amount UK’s richest pay in tax is misleading and ignores fair taxation issue - Patriotic Millionaires 09.10.24452733

- Guido Fawkes rages over calls for UK to adopt Spain’s wealth tax - LFF 24.08.24429583

- Global Wealth Tax Could Raise $2.1 Trillion Annually for Climate Action and More - CD 19.08.24429072

- Former Sunak adviser urges Labour to introduce wealth tax on housing - Guardian 17.08.24428870

- Super-rich being advised how to avoid Labour tax clampdown, undercover investigation suggests - Guardian 25.07.24424614

- The rich were led to believe they were different. Those days are numbered - Guardian 14.07.24422744

- Labour can end austerity at a stroke – by taxing the rich and taxing them hard - Guardian 14.07.24422740

- Private equity bosses ponder leaving UK over Labour tax rise fears - Euronews 10.07.24422745

- To Rebuild Britain, Tax the Rich. - Tribune 09.07.24422741

- ‘Living under Labour will cost me millions – it’s unbelievably depressing’ - Telegraph 09.07.24422742

- Tax paid by UK non-doms rose to £8.9bn in 2022-23 - FT 09.07.24422743

- The wealth taxes that Labour could bring to Britain - Telegraph 06.07.24422133

- Wealthy sell UK assets amid fears Labour would raise capital gains tax FT 03.07.24422127

- How a Labour wealth tax could completely backfire - Telegraph 01.07.24422135

- Voters back taxing rich more to help pay for NHS, poll finds – as report shows Sunak wealthier than the King - Independent 17.05.24 422141

- I’m a non-dom millionaire living in Britain. Taxing me fairly won’t make me leave - Guardian 08.05.24413867

- Death duties – Withhold your tax ethically! - Transnational 15.04.24413684

- Taxing the wealth of UK’s richest would raise billions for public services - Guardian 09.04.24422125

- How wealth taxes could fund a fairer, greener Britain - Greenpeace 29.02.24422120

- Capital gains: Sunak and Starmer’s tax bills show how the system benefits the rich - Conversation 20.02.24422136

- Tax Squeeze on UK’s Top 1% Unlikely to Trigger Exodus, LSE Finds - Bloomberg 22.01.24422132

- 260 global millionaires sign letter to political leaders demanding to pay more taxes - LFF 17.01.24394574

- What do the rich really think about a wealth tax? Not what you might imagine - Guardian 17.01.24422124

- Billionaires should face a minimum tax rate, report says - BBC 23.10.23422134

- Wealth flight: should we care when the rich threaten to go into tax exile? - FT 16.10.23422128

- Tax the rich, says Oxfam - Ecologist 18.09.23373363

- Paul Nowak: Here’s how we can change our tax system to ensure the rich pay a fairer share - LFF 22.08.23369852

- Wiki: How to tax the superrich (with pictures) - TaxJustice 19.08.24452732

- ‘Modest’ wealth tax on richest 0.3% could raise more than £10bn for public services, says TUC - LFF 15.08.23366369

- Modest wealth tax on richest 0.3% could yield £10bn for the public purse – as TUC calls for “national conversation on tax” 11.08.23422122

- Tax the Rich - Left EU 13.07.23361455

- The Sunday Times Rich List is back. Is it time for a wealth tax? = Big Issue 19.05.23422137

- Why a UK wealth tax would fail - Taxation 15.05.23422142

- How much tax do the rich really pay? Evidence from the UK - University of Birmingham 24.04.23422140

- Why won’t Labour say it will tax Rishi Sunak and the super-rich more? - New Statesman 06.04.23358933

- Audio: How to tax the rich? - IFS 24.02.23422123

- Three quarters of Britons support wealth taxes on millionaires - You Gov 23.01.23422130

- The super rich pay lower taxes than you - and here's how they do it... - Oxfam 18.01.23422129

- It’s time for a new tax on the UK’s wealthiest 1% – arguments against it don’t add up - Guardian 20.09.22304180

- It’s time for the UK to introduce a wealth tax - Left Foot Forward 17.06.22304188

- Research briefing: Potential merits of introducing new wealth taxes - House of Commons Library 10.06.22304196

- “Patriotic Millionaires” in the U.K. call for higher taxes … on themselves - Marketplace 05.04.22304184

- How to introduce a radical wealth tax - OMFIF 23.03.22304185

- UK should bring forward tax rises to fight inflation, IMF says - Financial Times 23.02.22304191

- Taxing wealth of UK’s richest ‘could cover rising health and social care costs twice over’ - Independent 19.01.22304183

- What are the Barriers to Taxing Wealth? The Case of a Wealth Tax Proposal in the UK - Cambridge 06.12.21304200

- Public attitudes to a wealth tax: the importance of ‘capacity to pay’ - Wiley 25.10.21304194

- Taxes on wealth: time for another look? - IFS 25.10.21304197

- It’s time for a new tax on the UK’s wealthiest 1% – arguments against it don’t add up - Guardian 20.09.21256445

- Video: Wealth tax now - Canary 08.09.21254932

- Rich List 2021: results will renew debate on wealth tax in Britain - Guardian 21.05.21245086

- Wealth tax would raise far more money than previously thought - Policy Note 11.03.21304201

- How much tax do the rich really pay? - LSE 14.01.21422126

- Taxing the Wealthy Is Always Popular - Bloomberg 29.12.20304199

- Taxing the rich: How a UK wealth tax could work - Al Jazeera 09.12.20227456

- One-off 5% wealth tax would raise £262bn to cover Covid costs, study finds - FT 08.12.20304203

- Super-rich prepare to leave UK 'within minutes' if Labour wins election - Guardian 02.11.19190766

- From Trump to Johnson, nationalists are on the rise – backed by billionaire oligarchs - George Monbiot 26.07.19190768

- Taxing wealth: The Green Party’s proposal for a Wealth Tax on the top 1% - Green Party 07/14304187

- Why Was a Wealth Tax for the UK Abandoned? Lessons for the Policy Process and Tackling Wealth Inequality - ResearchGate 04/12304193